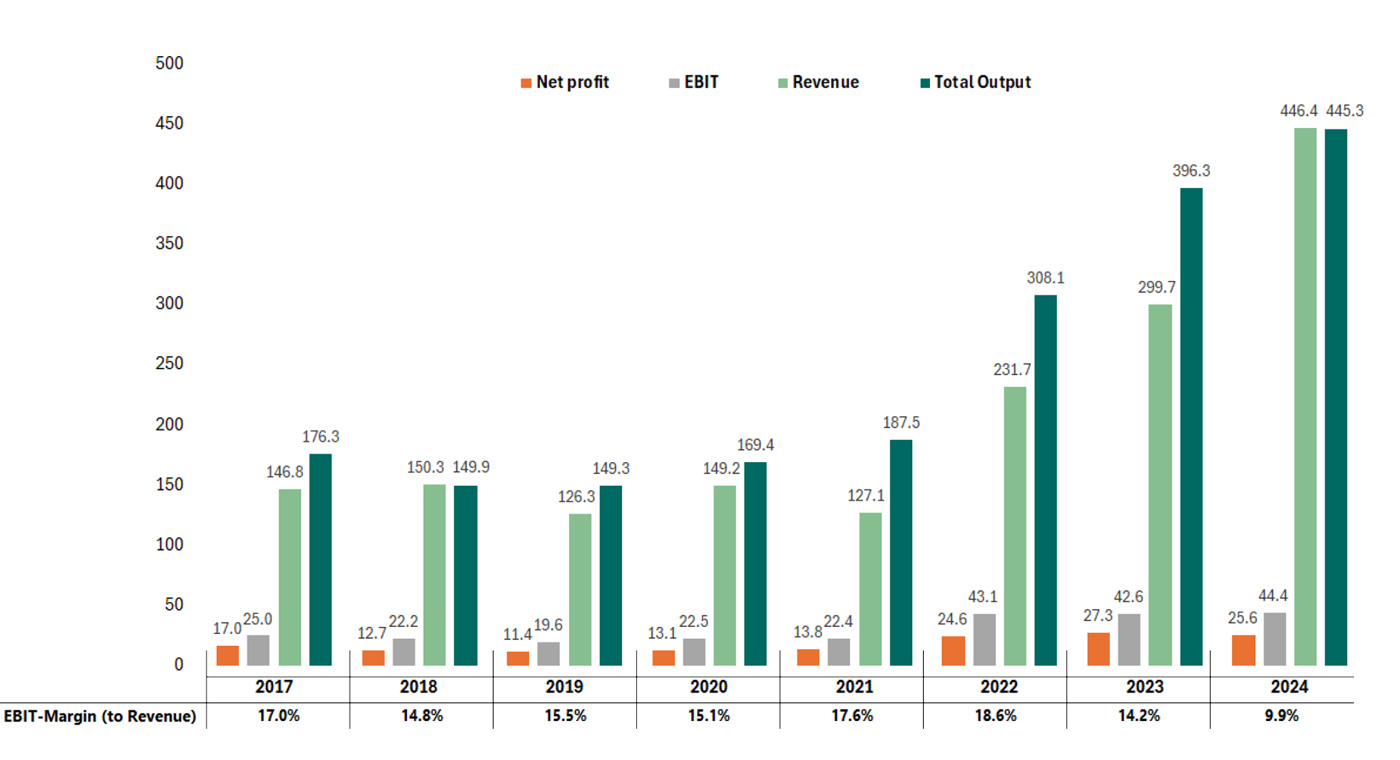

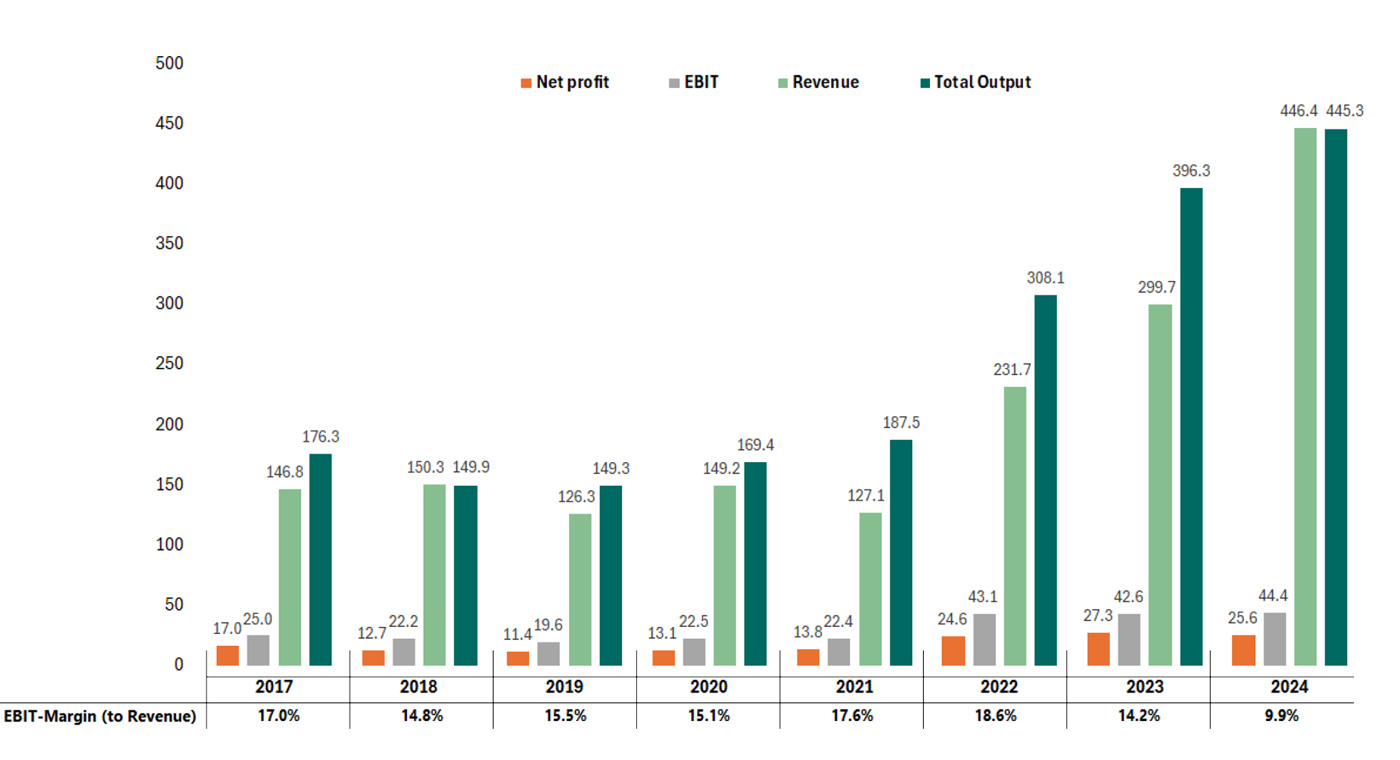

Earnings development

Since its foundation in 1996, the company has always reported positive figures. In 2016, the annual net profit exceeded the ten-million-euro mark for the first time. In the years that followed, the group always achieved net profits in the double-digit million-euro range. In 2022, the threshold of 20 million euros was exceeded for the first time. This level should also be maintained in the coming financial years. This expectation is based on the fact that more renewable energy parks in the planning phase are ready for construction and can thus be exploited economically (overview projects in development).

Financial figures per share

| (EUR) |

2017 |

2018 |

2019 |

2020 |

2021 |

2022 |

2023 |

2024 |

| EBITDA |

4.94 |

4.24 |

3.43 |

3.77 |

3.31 |

6.18 |

6.44 |

7.11 |

| Net Profit |

2.22 |

1.67 |

1.41 |

1.42 |

1.50 |

2.67 |

2.95 |

2.77 |

| Dividend |

0.40 |

0.42 |

0.42 |

0.45 |

0.49

|

0.54 |

0.60 |

0.65* |

| Book value (as of 31.12) |

10.4 |

11.64 |

12.83 |

15.20 |

16.25 |

18.4 |

20.91 |

23.1 |

| Share price (as of 31.12) |

12.0 |

13.80 |

17.30 |

46.40 |

55.8 |

74.20 |

41.10 |

36.10 |

| Price-earnings ratio |

5.4 |

8.28 |

12.27 |

32.7 |

37.2 |

27.8 |

13.9 |

13.0 |

*Proposal to the General Assembly

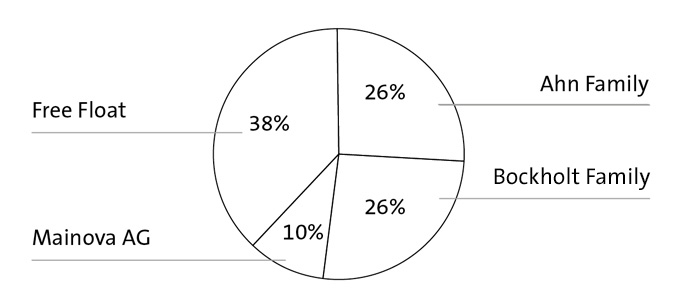

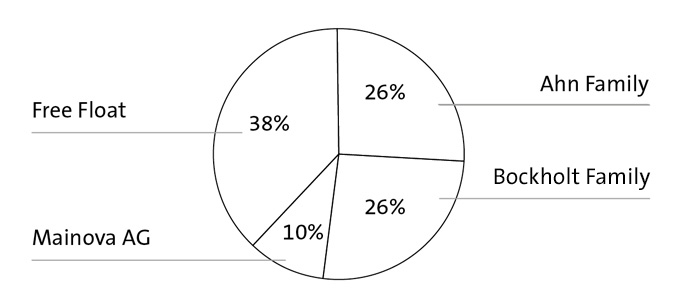

Shareholder Structure

The families of Matthias Bockholt und Dr. Jochen Ahn, both founders, each hold approximately 26 percent of the shares. Both have divided their share among their spouse and three children. None of these ten shareholders owns more than 9 percent of the shares.

Thus, the largest single shareholder is Mainova AG, an energy supplier based in Frankfurt/Main, owning approximately ten percent of the shares. To the Company's knowledge, no other shareholder holds more than three percent of the shares.

The shareholders within the free float include: GS&P, Capricorn, Enalco, Enkraft, Sustainvest, Value-Partnership, Aguja, KBC, Baring Asset, Murphy&Spitz, Spirit Asset Management and PFP Advisory.

Unlike the regulated market, investors in over-the-counter trading are not legally obligated to report when their voting rights cross a certain threshold. Only if another company owns more than 25 percent of the shares, it has to inform the company. Thus ABO Energy does not have a secured overview of their shareholders or the number of shares they hold.